The Long Game: Inside HighRadius’s Rise and the Mind Behind It

In a bustling era of spreadsheets, endless reconciliations, and the constant hum of financial teams chasing clarity, there arose a company that dared to shift the narrative. HighRadius was its name.

The company began with a simple, but bold promise: to bring measurable, real value to the Office of the CFO.

Built on a conviction that finance teams shouldn’t just automate tasks, but actually improve the outcomes that matter, HighRadius today anchors its story around one core truth: value creation.

Since its founding in 2006, HighRadius has quietly grown into a global force. Today, it competes with big names like SAP, Tradeshift, Kyriba, and Tipalti.

HighRadius supports 1,100+ enterprises across continents with a single agentic AI platform. This platform houses over 180 specialized AI agents orchestrating entire finance processes, from Order-to-Cash to Treasury.

What stands out isn’t the number of features, but the focus on measurable KPIs: ensuring real improvements to be achieved in 3 to 6 months.

In this story, we’ll trace how HighRadius journeyed from being a niche accounts-receivable startup to becoming a platform trusted by major global brands. We’ll also dive into the founder, Sashi Narahari’s journey, his motivations, the hurdles he faced, and how these factors shaped the company’s direction.

What HighRadius Does and Why It Matters to Finance Teams

HighRadius is a cloud-based SaaS platform built for the “Office of the CFO,” which basically means it focuses on the full spectrum of finance operations. The platform houses over 180 AI agents, with each agent automating or orchestrating specific finance processes across multiple functions.

It is built to be ERP-agnostic. This means it integrates with many different enterprise systems, legacy platforms, and third-party data sources, so it can plug into a firm’s existing finance ecosystem.

HighRadius covers several key finance domains. Here are the core areas and what they address:

- Order-to-Cash: This refers to collections management, cash application, deductions, credit management, and electronic invoicing. It helps shorten the time from invoice to cash and reduces errors and manual work.

- Accounts Payable: This entails automation of invoice processing, supplier portals, and vendor payments. This cuts cost and risk on the pay-side of finance.

- B2B Payments: This is all about handling payment rails, surcharge management, and interchange fee optimization. This function makes sure both outbound payments and inbound collections operate efficiently.

- Close & Reconciliation: This includes balance sheet reconciliation, revenue reconciliation, inter-company management, and financial close tasks. These are areas where finance teams often struggle with accuracy and timelines.

- Consolidation & Reporting: This refers to financial consolidation across entities, creation of P&L, balance sheet, cash-flow statements, and management reporting. It helps enterprises bring together data for insights and control.

- Treasury & Risk: This includes cash management, forecasting, and treasury payments. This keeps the “finance of finance” (liquidity, working capital, risk) in focus.

How Clients Benefit

Because a lot of what finance teams do is routine, error-prone, or manual, HighRadius brings a few specific advantages.

- Faster cash flow and reduced DSO (Days Sales Outstanding): By automating cash application and collections, firms can convert receivables into cash more quickly.

- Reduced manual work, higher productivity: AI agents handle many repetitive tasks, so human teams can focus on exceptions and decisions.

- Better control and risk management: With modules like credit management, reconciliation, and treasury, finance teams gain tighter control over risk, bad debt, and working capital.

- Measurable outcomes in a defined timeframe: The company emphasizes that measurable KPIs are part of the promise. Performance improvements can be expected in 3-6 months in many cases.

- Scalability and flexibility: Because the platform is ERP-agnostic and modular, companies can adopt the parts they need and scale over time rather than replacing everything all at once.

Why This Matters

It’s no secret that finance functions have evolved over the years. They’re no longer simply about bookkeeping or reactive; they drive strategy. This means performing tasks such as working capital optimization, forecasting, and decision support. HighRadius comes in as a platform that aligns with this goal. It’s not just about doing things faster, but doing them better, more reliably, and with metrics to prove it.

Here’s what all of this means: when the finance engine runs smoother, cash is freed up, risks are lowered, and the organization can move forward with clarity. HighRadius is the platform that offers a safe path to that outcome.

On another note, in case you’re wondering why the company is called HighRadius, there’s no explanation about the exact inspiration behind this name. The term itself suggests a high-reach and expansive scope around a centre (radius). It fits the company’s ambition: to reach broadly (global enterprises) while revolving around the “radius” of the CFO’s office, bringing finance functions into one circle.

The Mind behind HighRadius: Sashi Narahari

Sashi Narahari studied Mechanical Engineering at the Indian Institute of Technology Madras (IIT Madras) for his Bachelor’s, and then pursued a Master’s at the University of Maryland, College Park.

Despite his engineering background, his interest gravitated toward understanding business systems, process logic, and how large organizations handled finance operations.

Before HighRadius, Sashi worked with enterprise software and systems, including roles in consulting and data management. He observed that many large companies were doing the same things over and over in their finance back-office: receivables, collections, and cash application.

As such, he found the systems to be manual, error-prone, and slow. He saw a gap waiting to be plugged: combine domain knowledge (finance ops) with software and automation. He decided he could do better.

In 2006, Sashi founded HighRadius. His motivation?

- Make the finance team of a company not just operate, but perform better.

- Give CFOs tools that deliver measurable results.

- Change the expectation that the finance back-office is a cost centre, and turn it into a function that offers working capital, cash flow, and insight.

He believed this was possible with deeper process-engineering, data, and now software.

Sashi sees HighRadius as not just a software company, but as a platform that helps finance functions run with agility and insight. He wants the platform to be the tool CFOs trust to shift from “keeping the lights on” to “driving value.” The core idea is that finance isn’t a back-office cost anymore; it’s a part of the strategic engine.

As for how he plans to get there, the plan involves deeper AI agents, broader finance scope (receivables, payables, treasury, reporting), global scale, and measurable business outcomes.

The Hard Road: Sashi Narahari’s Tumultuous Journey with HighRadius

When Sashi founded HighRadius in 2006, he wasn’t chasing the startup spotlight. He wanted to fix a quiet, but deeply frustrating problem he’d seen up close: the inefficiency buried inside corporate finance departments.

At the time, Order-to-Cash processes were still manual. Teams spent days matching invoices, applying payments, and chasing overdue balances. To make things worse, the systems were disconnected, which further slowed things down.

Sashi believed there had to be a smarter way.

With his background in engineering and experience in enterprise software, he decided to build a company that could turn finance from a slow, reactive function into one that actively created value.

The early years weren’t glamorous. HighRadius was bootstrapped for more than a decade, a rarity in the SaaS world. There were no big investors cushioning its research and no loud marketing campaigns. Growth came slowly, one client at a time.

Sashi and his small team had to convince large, established enterprises to trust their young platform, promising AI-driven finance automation. It was an uphill battle because most finance leaders saw automation as an option, not a must-have. Further, legacy systems made integration complex and time-consuming.

But Sashi decided to be patient. He knew that once clients saw measurable improvements in real metrics (like reduced DSO or faster cash flow), they’d understand the value for themselves.

But, funding wasn’t the only challenge. Scaling a global enterprise platform from scratch meant rethinking everything, from product architecture to the delivery model, and even the company’s story.

HighRadius started with a narrow focus on accounts receivable automation, but Sashi knew that the real transformation would come only when the entire Office of the CFO was connected. Over time, the platform expanded into payables, treasury, reconciliation, and reporting. It was a deliberate, careful evolution that reflected his conviction that growth should be earned, not rushed.

Sashi’s resilience became the company’s backbone. Instead of chasing hype, he built trust. Rather than selling features, he sold outcomes. By staying independent through its formative years, HighRadius avoided the chaos of external pressure and grew on its own terms. Each new client added proof, and each success solidified their credibility.

Slowly, the company that operated from a small office in Houston began working with some of the largest enterprises in the world.

Sashi’s journey is a reminder that great companies aren’t always born from grand beginnings. Sometimes, they’re built through patience, purpose, and a refusal to quit. He didn’t just create software, but redefined what finance automation could mean. And this belief, tested through years of struggle and persistence, became the foundation on which HighRadius stands today.

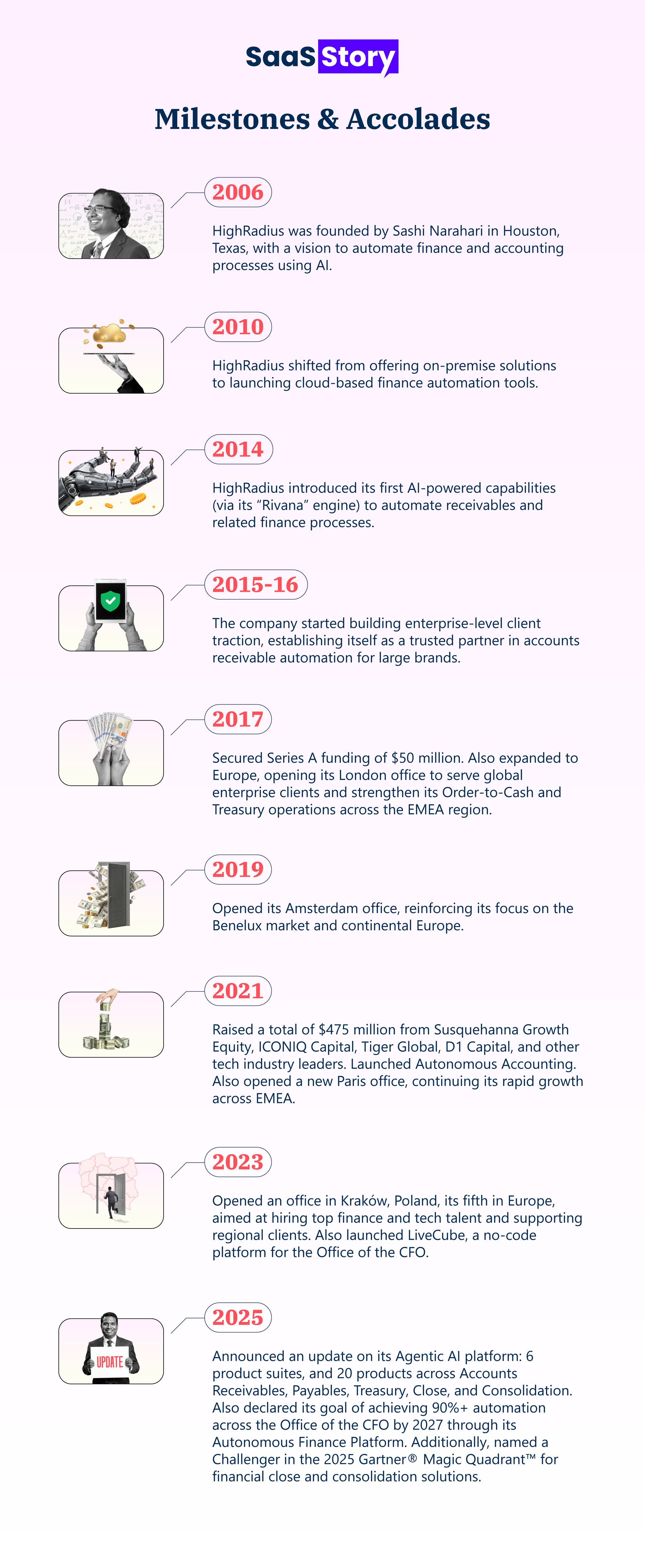

Milestones & Accolades

As you sow, so shall you reap. With this in mind, let’s glance at the various achievements and praises HighRadius has earned since it started existing.

Key Lessons to Learn from HighRadius’s Story

Here are five strategic lessons every entrepreneur can learn from HighRadius’s journey, drawn from its growth and leadership mindset.

1. Build Slow, But Right

HighRadius didn’t chase overnight success. It spent nearly a decade refining its technology before taking any big funding. That patience paid off. By the time investors showed interest, the company already had product-market fit and paying enterprise clients.

The lesson: speed is meaningless if the foundation isn’t strong.

2. Solve One Painful Problem, Completely

Instead of trying to automate everything in finance, HighRadius began with one specific pain point: getting paid on time. The platform started as a tool for receivables automation and expanded only after proving measurable value.

The takeaway: Where most entrepreneurs often overextend, HighRadius focused, fixed, and then scaled.

3. Let Technology Serve Business, Not the Other Way Around

Sashi Narahari didn’t build AI for the sake of keeping up with trends. Every AI agent at HighRadius is tied to a business KPI. This simple decision is why CFOs trust it.

Lesson for founders: Innovation means nothing unless it improves real-world metrics.

4. Keep Your Roots, But Think Global

While headquartered in the U.S., HighRadius stayed deeply connected to its Indian roots. It kept attracting tech talent, building strong R&D centers, and keeping a frugal, engineering-driven culture.

The result: A company that feels both grounded and global. It is possible to start local and yet grow globally.

5. Play the Long Game

Sashi Narahari always knew one thing: he was building an enduring business. HighRadius stayed private for nearly two decades and grew through client trust, not hype.

The key learning: Longevity still matters, and that a company’s true worth lies not in its valuation, but in how long it can keep creating value.

Conclusion

Some companies roar into existence, while others arrive quietly and prove themselves over time. HighRadius falls in the second category. From a small Houston setup in 2006 to an AI-driven powerhouse serving global enterprises, its story isn’t just about technology, but about conviction.

Sashi Narahari built HighRadius because he saw something broken in the way companies managed money. He truly believed it could be fixed. Every stage of the company’s journey speaks the simple truth: staying power comes from purpose. And this is exactly what sets HighRadius apart.

Today, with its Agentic AI platform shaping the future of corporate finance, HighRadius is redefining trends. For entrepreneurs, its legacy isn’t just in valuation or scale, but in the mindset that made it possible: build with patience, solve with precision, and grow with integrity. And these are lessons worth remembering!

Subscribe to our newsletter.

Be the first to know - subscribe today